Avoid penalties and stay on schedule by filing the 2290 tax form early

Avoid penalties and stay on schedule by filing the 2290 tax form early

Blog Article

An HHO system for cars and trucks is the ideal solution nowadays to combat rising fuel prices. Most people are looking to reduce their spending on gas. Many are opting for smaller and lighter cars. Another alternative is an HHO system which is a simple add on to the existing engine but produces savings from 25% right up to 60%.

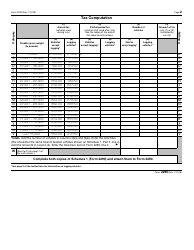

When you have inventory you are on modified cash basis and that is the preferred 2290 tax form method for sole proprietorships and the one I have found works best with artists.

Among these Form 2290 online choices filing through a company makes the most sense. This option allows you to transfer work to the firm you hire. Of course, reasonable fees will apply, but you get the most out of your money since they will complete the legwork while you just wait for results.

If your answer is yes, then read on. What I'm going to layout here is a plan that you can put into action, even if you choose not to work with me. Remember the most important variable in starting a business today is YOU. People want to make more money today and do it in less time with less stress. They want no ceiling on their money making capacity.

I would like to go into the differences between a C corporation and an S corporation. C is the corporations we are most familiar with - corporate monsters like Microsoft, IBM, Disney, Sears, etc. These get IRS heavy vehicle tax at a corporate rate, which is currently 15% up to $50,000 in profit, and goes up from there. An S Corporation E-file 2290 (S stands for Small) has to have less than 100 stockholders (among other requirements) but does NOT get taxed at the corporate level. Let me repeat that - no tax is paid on the corporation itself. Instead, the income gets reported on each shareholder's tax return, and is paid at their personal rate. This is usually the better deal for small companies, as personal returns are not taxed at all for the first $7000 in income.

In most cases, you won't need to pay a deposit. If the building firm asks for one, make sure there is good reason for this. It may be that the job is so big that they require some form of collateral or they may need to order materials. If you're in any doubt, speak to the National Federation of Builders.

Keep out of Trouble: Adopting good habits and consistently using them will keep you out of trouble with the IRS for good. Don't hesitate, use your new knowledge and stay out of Debt. Report this page